Interest expenditure can be deducted when calculating Taxable Income for the Tax Period in which it is incurred.170 However, there are some limitations on the deduction of Interest expenditure.171

General Interest Deduction Limitation Rule

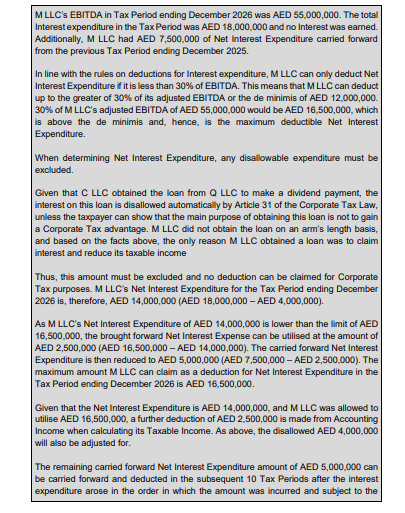

C LLC has Revenue of AED 150,000,000, adjusted EBITDA of AED 130,000,000 and Profit Before Tax of AED 60,000,000 for its Financial Year ending 31 December 2025. In 2025, C LLC incurs costs including Interest expenditure of AED 80,000,000. C LLC also receives Interest income of AED 30,000,000, resulting in a Net Interest Expenditure of AED 50,000,000.

C LLC may deduct its Net Interest Expenditure of AED 50,000,000 up to the greater of 30% of its adjusted EBITDA or the de minimis of AED 12,000,000. 30% of C LLC’s adjusted EBITDA of AED 130,000,000 would be AED 39,000,000, which is above the de minimis and, hence, is the maximum deductible Net Interest Expenditure in 2025.

C LLC’s total Net Interest Expenditure in 2025 is AED 50,000,000 and C LLC may only deduct AED 39,000,000 of Net Interest Expenditure in this Tax Period. AED 11,000,000 of Net Interest Expenditure would be disallowed in 2025 and carried forward to the subsequent Tax Periods (up to 10 Tax Periods).

In the Financial Year ending 31 December 2026, C LLC had Revenue of AED 200,000,000, adjusted EBITDA of AED 180,000,000 and Profit Before Tax of AED 140,000,000. C LLC incurs Interest expenditure of AED 80,000,000 and also receives Interest income of AED 60,000,000, resulting in a Net Interest Expenditure of AED 20,000,000 for 2026.

In 2026, 30% of C LLC’s adjusted EBITDA of AED 180,000,000 would be AED 54,000,000, which is above the de minimis and, hence, is the maximum deductible Net Interest Expenditure in 2026. C LLC can deduct all of its Net Interest Expenditure in the period of AED 20,000,000, as well as an additional amount up to AED 34,000,000 of Net Interest Expenditure in the period. Hence, it may utilise its carried forward Net Interest Expenditure of AED 11,000,000 from 2025 and further reduce its Taxable Income in 2026. This would result in a Taxable Income of AED 129,000,000 for 2026.

The Corporate Tax Law refers to the amount of Interest that is deductible as Net Interest Expenditure. Net Interest Expenditure is the difference between the amount of Interest expenditure incurred (including any carried forward Net Interest Expenditure) and the Interest income derived during a Tax Period.172

When the Net Interest Expenditure exceeds AED 12,000,000 in a Tax Period, the amount of deductible Net Interest Expenditure is the greater of:

• 30% of EBITDA (earnings before the deduction of Interest, tax, depreciation and amortisation) for a Tax Period, calculated as the Taxable Income for the Tax Period with adjustments for:173

o Net Interest Expenditure for the relevant Tax Period,

o Depreciation and amortisation expenditure taken into account in determining the Taxable Income for the relevant Tax Period, and

o Any Interest income or expenditure relating to historical financial assets or liabilities held prior to 9 December 2022. and,

• the de minimis threshold of AED 12,000,000.174

This is known as the “General Interest Deduction Limitation Rule”.

For the purpose of the General Interest Deduction Limitation Rule, any amount on Islamic Financial Instruments that is economically equivalent to Interest under a conventional financing arrangement will be treated as Interest.175

Any Net Interest Expenditure disallowed in a Tax Period by the General Interest Deduction Limitation Rule can be carried forward and utilised in the subsequent 10 Tax Periods in the order in which the amount was incurred, subject to the same conditions.176

The General Interest Deduction Limitation Rule does not apply to:

• Banks;177

• Insurance Providers;178 or

• Natural persons undertaking a Business or Business Activity in the UAE.179

In addition, Resident Persons who are responsible for, or who facilitate the provision, maintenance, or operation of Qualifying Infrastructure Projects, i.e. specific long-term infrastructure projects that meet the following conditions, shall not be subject to the General Interest Deduction Limitation Rule in relation to Net Interest Expenditure incurred from the financing of these projects. A project will be considered as a Qualifying Infrastructure Project where all the following conditions are met:180

• It is exclusively for the public benefit of the UAE;

• It is exclusively for the purposes of providing transport, utilities, education, healthcare or any other service within the UAE as may be specified by the Minister;

• Its assets may not be disposed of at the discretion of the relevant Qualifying Infrastructure Project Person;

• The assets provided, operated or maintained by the project should last, or be expected to last for at least ten years, or another period as may be specified by the Minister;

• The project assets are situated in UAE’s Territory;

• All of the project’s Interest income and Interest expenditure arise in the UAE; and

• The project satisfies any other conditions that may be prescribed by the Minister.

If Net Interest Expenditure is below the AED 12,000,000 de minimis threshold for a Tax Period, the General Interest Deduction Limitation Rule does not apply.181 This means that, subject to the provision of Article 30 of the Corporate Tax Law, the full amount of Interest expenditure incurred in a Tax Period can be deducted.

Additionally, limitations on the deduction of Interest may impact the commerciality of some financing arrangements. As such, financing arrangements agreed prior to the publication date of the Corporate Tax Law (i.e. 9 December 2022), and that meet the other conditions specified in Ministerial Decision No. 126 of 2023, are not subject to the General Interest Deduction Limitation Rule restrictions.182

Specific Interest deduction limitation

No deduction is allowed for Interest expenditure incurred on a loan obtained, directly or indirectly, from a Related Party in respect of any of the following transactions:

• A dividend or profit distribution to a Related Party;183

• A redemption, repurchase, reduction or return of share capital to a Related Party;184

• A capital contribution to a Related Party;185 or

• The acquisition of an ownership Interest in a Business that is, or becomes, a Related Party following the acquisition.186

The purpose of this provision is to prevent the Corporate Tax base from being eroded by transactions and arrangements between Taxable Persons and their Related Parties for the sole or main purpose of creating deductible interest expenditure where the income derived from the relevant transaction or arrangement can benefit from an exemption from Corporate Tax.

Whilst generally these deductions are not allowable for Corporate Tax purposes, the deduction restriction does not apply if the Taxable Person can demonstrate that the main purpose of obtaining the loan and carrying out the transaction is not to gain a Corporate Tax advantage. 187 This will be based on the specific facts and circumstances applicable to each transaction. However, if it can be demonstrated that the Related Party receiving the Interest is subject to Corporate Tax or a similar tax in a foreign country at a rate of at least 9% on the Interest income, then no Corporate Tax advantage will be deemed to have arisen.188

For further details on the General Interest Deduction Limitation Rule, readers are advised to consult Ministerial Decision No. 126 of 2023 on the General Interest Deduction Limitation Rule.

+9 71 4 393 1773

info@thevatconsultant.com

https://thevatconsultant.com