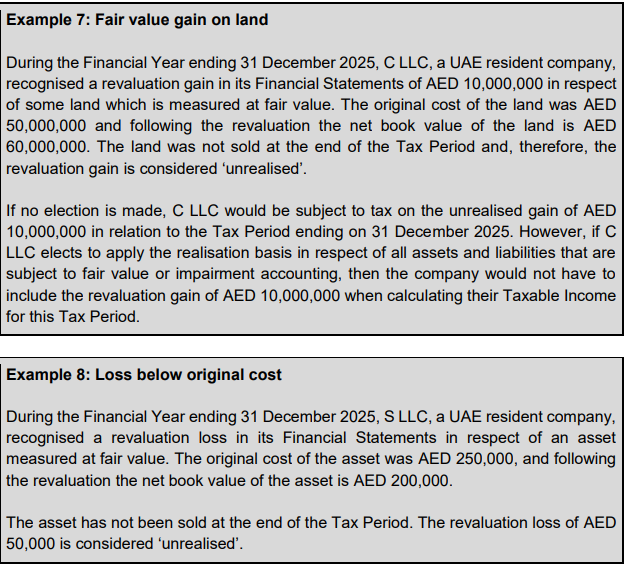

For the purpose of calculating their Taxable Income, businesses who prepare their Financial Statements using the Accrual Basis of Accounting may elect to take into account gains and losses on a realisation basis.128 Broadly, this election can be made either in relation to all assets and liabilities that are subject to fair value or impairment accounting under the applicable accounting standards (i.e. IFRS or IFRS for SMEs), or just those that are classified as capital under IFRS or IFRS for SMEs.129

Where the election has been made, the Taxable Person must exclude any unrealised gains and losses when the value of a non-Financial Asset changes.130

Additionally, where the election has been made, the Taxable Person will also exclude any change in the value of a liability or a Financial Asset when calculating gains or losses, unless they are calculating the gain or the loss upon the realisation of the liability or the Financial Asset.

Upon realisation of the asset or liability, the Taxable Person will need to include any amounts that were not previously taken into account for Corporate Tax purposes as a result of the adjustments mentioned above

Realisation includes selling or disposing of the asset or liability, transferring it, settling it, or writing it off in accordance with the accounting standards applied by the Taxable Person (i.e. IFRS or IFRS for SMEs)

The decision to make, or not make, an election to apply the realisation basis must be made by the Taxable Person during their first Tax Period, and will be deemed irrevocable except under exceptional circumstances and pursuant to approval by the FTA. If the Taxable Person does not make the election to apply the realisation basis in their first Tax Period then this will be considered an irrevocable election in itself.

+9 71 4 393 1773

info@thevatconsultant.com

https://thevatconsultant.com