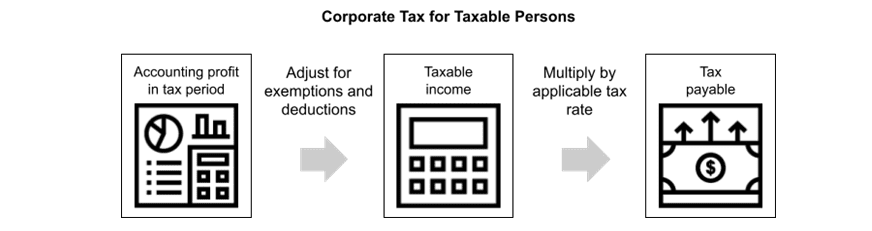

Taxable Persons are subject to Corporate Tax on their Taxable Income – this is their Accounting Income with certain adjustments made for Corporate Tax purposes.

Generally, Corporate Tax is imposed on Taxable Income at the following rates:

• 0% (zero percent) on the portion of the Taxable Income not exceeding AED 375,000.

1 Article 57 of the Corporate Tax Law. 2 Article 48 of the Corporate Tax Law. 3 Article 69 of the Corporate Tax Law.

• 9% (nine percent) on the portion of the Taxable Income exceeding AED 375,000.

Example 1: Calculation of Corporate Tax

A LLC is a company incorporated in the UAE. In the Tax Period ending March 2025, A LLC generated Revenue of AED 8 million and incurred expenses of AED 2 million, resulting in a net profit of AED 6 million per its Financial Statements.

A LLC’s Taxable Income for its Tax Period will be the accounting net profit (or loss) of the business, after making tax adjustments for certain items specified in the Corporate Tax Law. For the purposes of this example, A LLC does not need to make any tax adjustments, thus its Taxable Income will be AED 6 million for the Tax Period.

A LLC’s Corporate Tax liability will be calculated as follows:

• The first AED 375,000 of Taxable Income will be subject to Corporate Tax at 0%: AED 375,000 x 0% = AED0

• The portion of the Taxable income exceeding AED 375,000 will be subject to Corporate Tax at 9%: (AED 6,000,000 – AED 375,000) x 9% = AED 5,625,000 x 9% = AED 506,250

A LLC’s UAE Corporate Tax liability for the Tax Period will be AED 506,250.

In order to calculate its UAE Corporate Tax payable, A LLC will need to consider if there are any available tax credits to reduce its UAE Corporate Tax liability (see Section 9.3).

Specific rules cover the identification of Taxable Persons subject to Corporate Tax (see Section 5). The rules cover all companies and other legal entities (i.e. juridical persons) as well as individuals (i.e. natural persons) conducting a Business or Business Activity. As the UAE does not have an equivalent tax on the income of natural persons, this approach is intended to provide for a level playing field on the tax

treatment between incorporated businesses and unincorporated businesses undertaken by natural persons.

Employment income and other specific types of income earned by natural persons based in the UAE and natural persons based in foreign jurisdictions, are not within the scope of the UAE Corporate Tax regime (see Section 5.3.3).

Both incorporated and unincorporated businesses, including businesses operated by natural persons, can potentially benefit from small business relief if they meet the relevant requirements. This means that these businesses would not need to pay Corporate Tax (see Section 7.2) but they will be required to meet the compliance obligations provided for in the Corporate Tax Law for each Tax Period. This includes the obligation to register for Corporate Tax purposes, file a Tax Return and retain all relevant documents and records to support their Corporate Tax filings.

Provided that the relevant conditions are met, certain categories of Persons, known as Exempt Persons, are exempt from Corporate Tax, notably:

• Persons that are part of, or operate under the ownership and control of, the Federal Government or the Local Governments of the UAE;

• certain entities that are established for specific public welfare or social aims, such as certain public benefit entities;

• oil and gas and other Natural Resource activities that are taxed at the Emirate- level; and

• certain pensions or social security funds and investment funds.

Further details on Exempt Persons and the relevant qualifying conditions can be found in Section 5.7.

Taxable Persons must calculate their Taxable Income on an annual basis using their accounting net profit or loss for the relevant period as set out in their Financial Statements (i.e. their Accounting Income) as the starting point for this calculation. A number of adjustments should be applied to exclude specific Exempt Income, or to limit the amount of deductions available on expenditure (see Chapter 6).

The Corporate Tax regime also provides for the carry-forward and transfer of available Tax Losses (see Section 6.7), and requires Taxable Persons to specifically account for transactions with Related Parties and Connected Persons using the arm’s length principle (see Section 6.6).

A 0% rate of Corporate Tax applies to Qualifying Income earned by certain Free Zone entities (known as Qualifying Free Zone Persons). Further details can be found in Section 5.5 and Section 9.2.2.

The Corporate Tax regime also includes targeted reliefs designed to allow certain intra-group transactions to be undertaken without giving rise to a Corporate Tax liability. These are set out in Chapter 7.

Where Persons conduct Business together, either as groups of companies related by ownership, or as partnerships, special rules may apply for the calculation and payment of Corporate Tax. These are set out in Chapter 8.

Taxable Persons are required to self-assess their Corporate Tax liabilities by submitting a Tax Return on an annual basis and to pay the Corporate Tax liability to the FTA VAT. Tax Returns must be filed and payments made within nine months from the end of the Taxable Person’s Tax Period (see Section 10.5).

Other key aspects of the administration of Corporate Tax are set out in Chapter 10.

+9 71 4 393 1773

info@thevatconsultant.com

https://thevatconsultant.com