When a Free Zone Person meets certain conditions, it will be considered as a Qualifying Free Zone Person and is eligible for a 0% Corporate Tax rate on its Qualifying Income.41 The 0% Corporate Tax rate is available to Qualifying Free Zone

Persons until the expiry of the tax incentive period provided for in the legislation of the relevant Free Zone (unless renewed).42

In order to be considered as a Qualifying Free Zone Person, a Free Zone Person must meet the following requirements:

• derive Qualifying Income from relevant transactions (see Section 5.5.1);43

• maintain adequate substance in the UAE (see Section 5.5.4);44

• satisfy the de minimis requirement (see Section 5.5.5);45

• have not elected to be subject to Corporate Tax (see Section 5.5.6);46

• comply with the transfer pricing rules and documentation requirements under the Corporate Tax Law;47 and

• prepare and maintain audited Financial Statements for the purposes of the Corporate Tax Law.48

The Minister may prescribe additional conditions to be met by a Free Zone Person in order to be considered as a Qualifying Free Zone Person.49

For further details on the Free Zone Corporate Tax regime, readers are advised to consult Cabinet Decision No. 55 of 2023 on Determining Qualifying Income for the Qualifying Free Zone Person50 and the Ministerial Decision No. 139 of 2023 Regarding Qualifying Activities and Excluded Activities.51

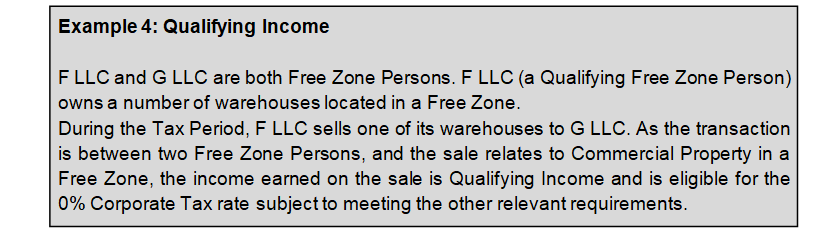

Qualifying Income

Qualifying Income is the income that can benefit from the 0% Corporate Tax rate.

Unlike ordinary Taxable Persons, Qualifying Free Zone Persons are not entitled to a 0% rate on their first AED 375,000 of Taxable Income that is not considered as Qualifying Income. Therefore, any Taxable Income that is not Qualifying Income will be taxed at the general rate of 9% (see Section 9.2.2).

Qualifying Income includes:52

• Income derived from transactions with other Free Zone Persons, except for income derived from Excluded Activities;53

• Income derived from transactions with any Non-Free Zone Person, domestic and foreign, only in the case of Qualifying Activities that are not Excluded Activities; and

• Any other income where the de minimis requirement is satisfied.

For further details on Qualifying Income, readers are advised to consult Cabinet Decision No. 55 of 2023 on Determining Qualifying Income for the Qualifying Free Zone Person and Ministerial Decision No. 139 of 2023 Regarding Qualifying Activities and Excluded Activities.

Excluded Activities

Qualifying Income does not include income derived from Excluded Activities.54 The Excluded Activities are listed in Ministerial Decision No. 139 of 2023 Regarding Qualifying Activities and Excluded Activities, and include:55

• Transactions with natural persons, except in relation to certain Qualifying Activities;

• Banking, insurance, finance and leasing activities that are subject to the relevant regulatory oversight of the relevant competent authority in the UAE, except for certain exceptions;

• Ownership or exploitation of UAE immovable property, other than Commercial Property located in a Free Zone provided such activity in relation to Immovable Property located in a Free Zone is conducted with other Free Zone Persons;

• Ownership or exploitation of intellectual property assets; and

• Activities that are ancillary (which serve no independent function) to the above activities.

Qualifying Activities

Qualifying Income includes income derived from transactions with Non-Free Zone Persons only in respect of Qualifying Activities. 56 These activities are defined in Ministerial Decision No. 139 of 2023, and include:57

• Manufacturing of goods or materials;

• Processing of goods or materials;

• Holding of shares and other securities;

• Ownership, management and operation of Ships;

• Reinsurance services subject to the regulatory oversight of the relevant competent authority in the UAE;

• Fund management services subject to the regulatory oversight by the relevant competent authority in the UAE;

• Wealth and investment management services subject to the regulatory oversight by the relevant competent authority in the UAE;

• Headquarter services to Related Parties;

• Treasury and financing services to Related Parties;

• Financing and leasing of Aircraft, including engines and rotable components;

• Distribution of goods or materials in or from a Designated Zone to a customer that resells such goods or materials, or parts thereof or processes or alters such goods or materials or parts thereof for the purposes of sale or resale;

• Logistics services; and

• Any ancillary activities (which serve no independent function) to the above activities.

Adequate substance requirements

To meet the adequate substance requirements, a Free Zone Person must have their core-income generating activities (e.g. the activities that are of central importance) performed within the Free Zone, these can be undertaken by the Free Zone Person or outsourced to a Related Party or third party who is located in a Free Zone. The Qualifying Free Zone Person must also have adequate supervision over any activities that are outsourced to a Free Zone Related Party or third party.58

The Qualifying Free Zone Person (or its outsourced party) must be able to demonstrate that it has adequate staff and assets, and that it incurs adequate operating expenditures within the Free Zone.

As businesses vary, ‘adequate substance’ is determined on a case-by-case basis, following the test criteria. This may include the number of qualified full-time employees, adequate operating expenditure and physical assets. In any case, the analysis also takes into account the nature and level of activities performed by the Qualifying Free Zone Person, the Qualifying Income earned, and any other relevant facts and circumstances.

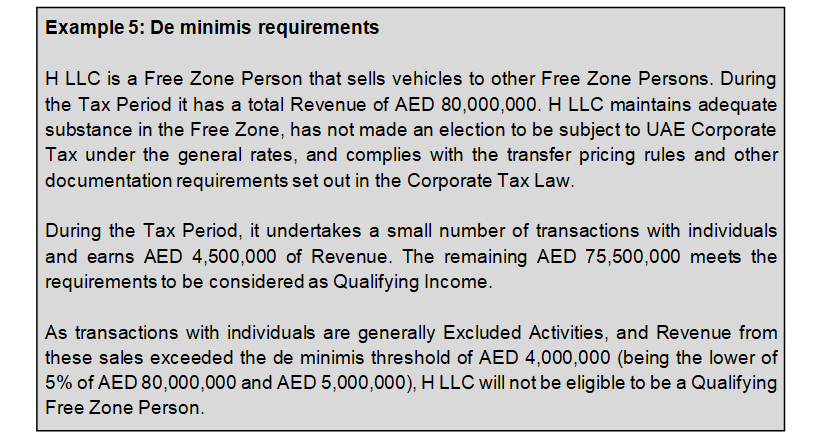

The de minimis requirement

For a Free Zone Person to be a Qualifying Free Zone Person, the de minimis requirements must be met.59

The de minimis requirements are met where the non-qualifying Revenue in a Tax Period does not exceed the lower of:60

• AED 5,000,000; and

• 5% of total Revenue (calculated as total amount of non-qualifying Revenue total Revenue).

The de minimis requirement allows a Qualifying Free Zone Person to earn a small or incidental amount of non-qualifying Income without being disqualified from the Free Zone Corporate Tax regime.61 Where the requirement has been met, income that does not fulfil the first two categories of Qualifying Income (see Section 5.5.1) will be treated as Qualifying Income.62

The total amount of non-qualifying Revenue as well as the amount of total Revenue (for the second limb of the de minimis requirement) are adjusted for by removing the following Revenues:

• Revenue attributable to a domestic or foreign Permanent Establishment of the Qualifying Free Zone Person;63 and

• Revenue attributable to the following transactions:

o Transactions with Non-Free Zone Persons in respect of Commercial Property located in a Free Zone;64 and

o Transactions with any Persons in respect of Immovable Property that is not Commercial Property located in a Free Zone.65

Election to be taxed at the general rates of Corporate Tax

A Qualifying Free Zone Person can elect to be taxed at the general rates of Corporate Tax.66 The election will be effective from either the commencement of the Tax Period in which the election is made, or the commencement of the following Tax Period and for the following four Tax Periods, after which the election can be made again.67

In addition, if a Qualifying Free Zone Person fails to meet any of the conditions above at any particular time during a Tax Period, it will cease to be eligible for the 0% Corporate Tax rate from the beginning of that Tax Period and will be taxed at the general rates of Corporate Tax for five Tax Periods starting with the Tax Period in which the conditions have not been met.68

A Free Zone Person that makes an election to be taxed at the general rates of Corporate Tax will cease to be, or not become, a Qualifying Free Zone Person, as they no longer satisfy the conditions. As a result, restrictions from applying certain provisions of the Corporate Tax Law will no longer apply. This means, for example, that the Free Zone Person can become a member of a Tax Group or elect for the small business relief subject to meeting the relevant conditions.

info@thevatconsultant.com

https://thevatconsultant.com