Several exemptions are provided for within the Corporate Tax regime.135 The purpose of these exemptions is to either:

•exempt income and capital gains arising from the activity of another juridical person or a foreign branch on the basis that it has already been taxed; or

•align the UAE Corporate Tax treatment with international standards, and in particular in relation to the taxation of international transportation.

These exemptions are symmetrical: any expenditure incurred in deriving Exempt Income cannot be deducted for Corporate Tax purposes.136 If expenditure is incurred for deriving both Taxable Income and Exempt Income, it must be apportioned, so that only the proportion of expenditure incurred wholly and exclusively for deriving Taxable Income will be deductible. If the proportion is not identifiable, then an appropriate proportion can be deducted if determined on a ‘fair and reasonable’ basis, having regard to all relevant facts and circumstances.137

What is fair and reasonable will depend on the circumstances and facts of each case. In many cases, there will be more than one method of apportioning expenses which is fair and reasonable to use. The fair and reasonable approach chosen should accurately reflect the underlying activity, should not be unnecessarily burdensome and complex for the Taxable Person to determine and justify, and for the FTA to understand and review.

Specific rules determine whether or not exemptions apply in particular circumstances. These are discussed in more detail below.

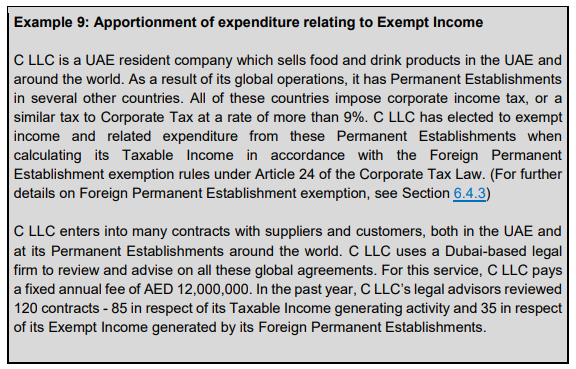

When calculating its Taxable Income, C LLC cannot claim the deduction of the total cost of the legal services. This is because some of the legal work related to the Foreign Permanent Establishments and, as the income from these are exempted from Corporate Tax due to the election made by C LLC, any related expenditure must also be excluded from the calculation of Taxable Income.

Only the proportion of expenditure incurred wholly and exclusively for deriving Taxable Income will be deductible. However, C LLC pays a fixed fee for legal services and the expenditure incurred in relation to its Taxable Income cannot be identified. It is therefore necessary to determine an appropriate proportion on a fair and reasonable basis.

As C LLC can identify the proportion of contracts which were sent for review in relation to its Taxable Income and Exempt Income generating activities, one of the possible ways that C LLC could determine the amount of the legal costs that would be deductible could be to apportion the expenditure according to the split of Taxable Income and Exempt Income generating activities based on the number of contracts. In other words, when calculating its Taxable Income, C LLC could claim a deduction of AED 8,500,000 (AED 12,000,000 x 85/120) related to its Taxable Income generating activity and consider the remaining AED 3,500,000 of legal expenses as attributable to Exempt Income earned by the Foreign Permanent Establishments and, therefore, not deductible.

The above approach assumes that the amount of work associated with each contract is equal. If, for example, C LLC received an itemised statement showing the amount of time their legal advisors spent on each contract, the legal fee could be apportioned according to the time spent on each contract. If the itemised statement revealed that the foreign contracts were more complex, and the legal advisors spent half of their time (and, therefore, half of the fees) reviewing the 35 foreign contracts, C LLC could claim a deduction of AED 6,000,000 (AED 12,000,000 x 50%), and consider the remaining AED 6,000,000 of legal expenses as attributable to Exempt Income earned by the Foreign Permanent Establishments and, therefore, not deductible.

These are just two illustrative ways that C LLC could apportion the legal fees and, depending on the facts and circumstances. Other methods may also be considered appropriate.

Domestic dividends

Dividends, and other profit distributions, received from a Resident Person are exempt from Corporate Tax. There are no additional conditions a Taxable Person has to meet in order to benefit from this exemption.138

This reflects a distinction between payments a juridical person makes in order to earn its profits, and distributions it makes out of its profits which will already have been taxed under the Corporate Tax regime. This exemption also covers distributions made by a Resident Free Zone juridical person (whether qualifying or not) to another Resident Person.

Income exempt under the participation exemption

+9 71 4 393 1773

info@thevatconsultant.com

https://thevatconsultant.com