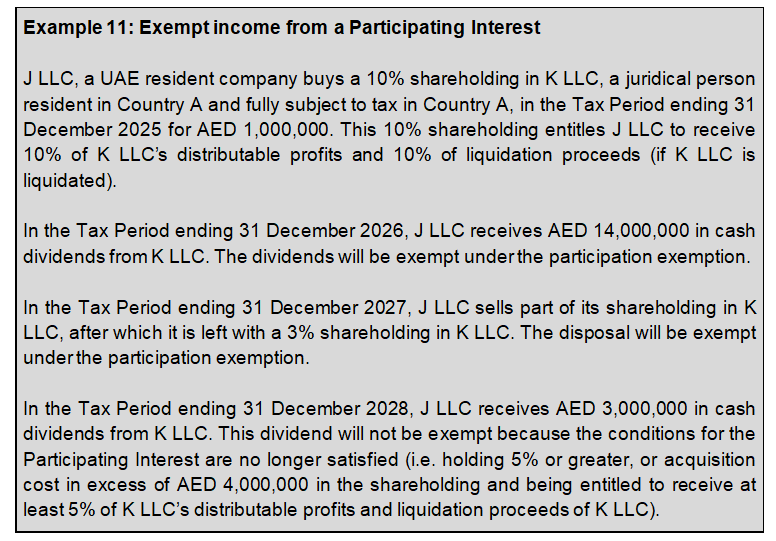

Dividends and other profit distributions received from foreign juridical persons are exempt from Corporate Tax if the recipient has a Participating Interest in the foreign company.139 A Participating Interest is a significant long-term ownership interest in the shares or capital of a juridical person (the “Participation”) that provides the basis for the exercise of some level of control or influence over the activities of the Participation. A Participating Interest exists where all of the following conditions are met:

• The Taxable Person has an ownership interest of 5% or greater in the shares or capital of the Participation which has been held, or is intended to be held, for a period of at least 12 months;140

• The Taxable Person is entitled to at least 5% of distributable profits and at least 5% of liquidation proceeds of the Participation;141

• No more than 50% of the Participation’s assets consist of ownership interests that would not have qualified for an exemption from Corporate Tax if they were held directly by the Taxable Person.142

• The Participation is subject to Corporate Tax, or a similar tax, in the country in which it is resident at a rate of at least 9% (i.e. the “subject to tax” requirement).143 A Participation is considered to meet this requirement for a given Tax Period when it is resident for tax purposes in a foreign jurisdiction throughout this same Tax Period, and:144

o that jurisdiction has a headline statutory tax rate of at least 9%, or

o it can demonstrate that it is subject to an effective tax on profits, income or equity of at least 9% in that jurisdiction.

The relief applies to various types of ownership interests. 145 Ownership interest includes holding any one or a combination of the following instruments:146

• Ordinary Shares;

• Preferred Shares;

• Redeemable Shares;

• Membership and Partner Interests; and

• Other types of securities, capital contributions and rights that entitle the owner to receive profits and liquidation proceeds.

In addition, an ownership interest with a historical acquisition cost of AED 4,000,000 or greater can qualify for the participation exemption.147

The participation exemption will not apply if, under the Corporate Tax legislation applicable in the foreign jurisdiction, the Participation can claim a deduction for the dividend or other distributions made to the Taxable Person.

info@thevatconsultant.com

https://thevatconsultant.com