General deductibility rules

Accounting Income is calculated by deducting a business’s expenditure from the Revenue generated in the same period. However, not all expenditure recognised under general accounting rules is deductible for Corporate Tax purposes. Non- deductible expenditure will need to be added back to Accounting Income when calculating Taxable Income.

The general rule is that expenditure must be incurred wholly and exclusively for the purposes of the Taxable Person’s Business and must not be capital in nature for the expenditure to be deductible for Corporate Tax purposes. 167 Additional specific deduction rules are applicable for entertainment and Interest expenditure.

Wholly and exclusively incurred expenditure

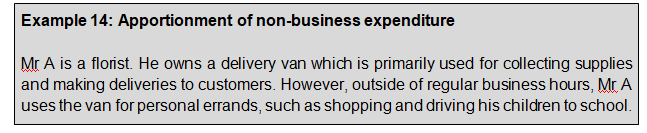

It is necessary to consider the purpose for incurring the expenditure to assess whether it can be deducted for Corporate Tax purposes. For it to be fully deductible, the expenditure needs to be incurred “wholly and exclusively” for Business purposes,

which means that the full amount has been incurred solely for these purposes. If the expenditure is incurred for non-Business purposes, then it must be added back when calculating Taxable Income.168

If expenditure is incurred partly for Business purposes and partly for some other purposes, the amount must be apportioned so that only the part relating to the derivation of Taxable Income will be allowed as a deduction. This includes any identifiable part or proportion of the expenditure incurred wholly and exclusively for Business purposes, as well as an amount that has been apportioned determined on a fair and reasonable basis.169

What is fair and reasonable will depend on the circumstances and facts of each case. In many cases, there would be more than one method of apportioning expenses which is fair and reasonable to use. The fair and reasonable approach chosen should accurately reflect the underlying activity, should not be unnecessarily burdensome and complex for the Taxable Person to determine and justify, and for the FTA to understand and review.

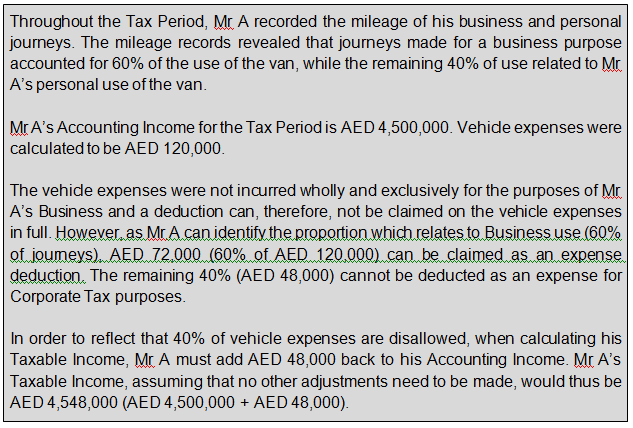

Capital expenditure

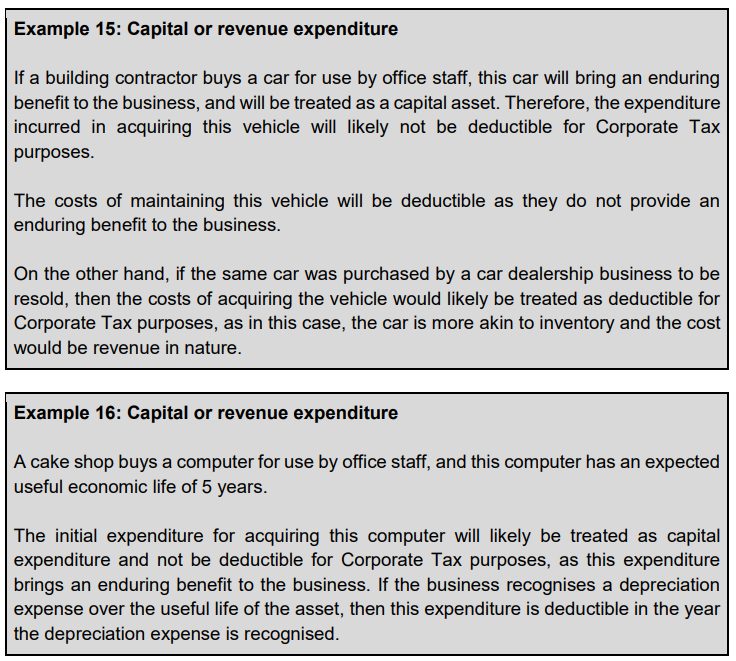

Capital expenditure is expenditure that creates an enduring benefit to a business and is not deductible for Corporate Tax purposes. This is in contrast to revenue expenditure which supports the day-to-day operations of the business. For example, purchasing a long-term asset like machinery would be a capital expense but paying for routine maintenance to keep the machinery running would be a revenue expense. The question of whether expenditure is of a capital or revenue nature will depend on the particular facts and circumstances, and will need to be determined on a case by case basis.

While capital expenditure is not deductible, the depreciation of the costs of capital assets is a deductible expense for Corporate Tax purposes. Depreciation is an accounting concept which allows for the cost of an asset to be spread over the life of the asset (representing the reduction of the asset’s value), even though there is no cash outlay to the business.

+9 71 4 393 1773

info@thevatconsultant.com

https://thevatconsultant.com