Other income and gains may also be exempt if they are derived from a Participating Interest. This applies to holdings in both Resident and Non-Resident Participations. The requirements for a Participating Interest in both a Resident and Non-Resident are the same, save that in relation to a Participation Interest in a Resident, a Participation in a Qualifying Free Zone Person or an Exempt Person is considered to meet the subject to tax requirement. If a Taxable Person holds a Participating Interest for a period of at least 12 months, or has the intention to do so, it will be exempt from Corporate Tax on:

• Gains or losses on the transfer, sale, or other disposition of the whole or part of the Participating Interest

• Foreign exchange gains or losses in relation to a Participating Interest

• Impairment gains or losses in relation to a Participating Interest.

Expenditure incurred in relation to the acquisition, transfer, sale, or other disposition of the whole or part of the Participating Interest will not be deductible.This includes professional fees, due diligence costs, litigation costs, commissions and brokerage fees, and other associated costs.

Only income received by the Taxable Person in their capacity as a shareholder (i.e. as an owner of the ownership interest) can be exempt. Other income earned from the Participation from other relations, such as that of a debtor-creditor (e.g. Interest income received) or buyer-seller (e.g. service fee received), will remain subject to Corporate Tax.155

For further details on the participation exemption, readers are advised to consult Ministerial Decision No. 116 of 2023 on Participation Exemption.156

Foreign Permanent Establishment exemption

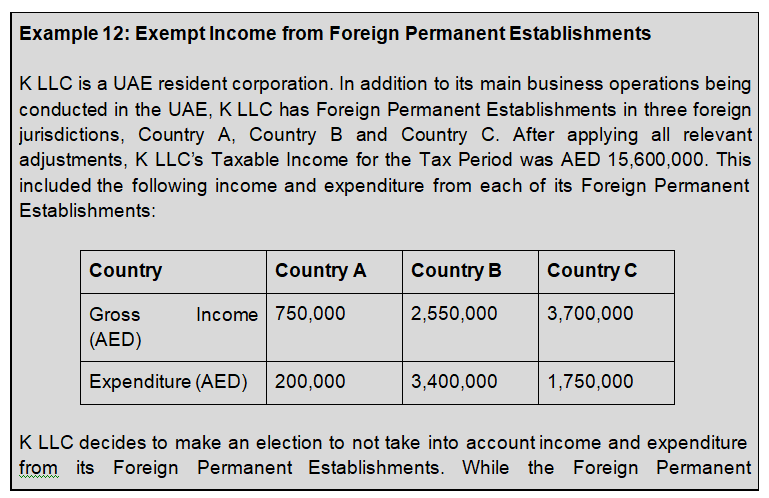

To eliminate or reduce potential international double taxation, a Resident Person can make an election when determining its Taxable Income to have income derived from Foreign Permanent Establishments exempted from Corporate Tax in the UAE.

Where such an election is made, the Resident Person will not need to include the following items in their Taxable Income:

• Income, and associated expenditure, in any of its Foreign Permanent Establishments; and

• Losses in any of its Foreign Permanent Establishments.

In addition, any Foreign Tax Credit that would have been available if the election had not been made will not be available to be used by the Resident Person.160

In determining income and associated expenditure, a Resident Person and its Foreign Permanent Establishments must be treated as separate and independent Businesses. Any transactions which take place between them must be treated as having taken place at Market Value.161

In the case of deciding to exclude the income, expenses and losses of the Foreign Permanent Establishments from the calculation of Taxable Income, the election will only apply to the Resident Person’s Foreign Permanent Establishments which are subject to Corporate Tax, or a tax of a similar character to Corporate Tax, in the relevant foreign country at a rate of not less than 9% (i.e. the “subject to tax requirement”).162

The election must apply to all foreign Permanent Establishments that meet the subject to tax requirement.163 A Resident Person may not elect to apply the exemption for specific Permanent Establishments.

Income from operating aircraft or ships in international transportation

The UAE is a major international logistics and transportation hub and, in recognition of this, income earned by a Non-Resident Person from the operation of aircraft or ships

in international transportation is exempt from Corporate Tax if certain conditions are met.164

In this regard, the Non-Resident Person should be in the Business of:

• International transport of passengers, livestock, mail, parcels, merchandise or goods by air or sea;

• Leasing or chartering aircrafts or ships used in international transportation; or

• Leasing of equipment which is integral to the seaworthiness of ships or airworthiness of aircrafts used in international transportation.165

In addition, the exemption only applies if the country in which the Non-Resident Person resides provides an equivalent exemption from Corporate Tax, or a similar tax, to UAE Resident Persons engaged in the operation of aircraft or ships in international transportation.166 This is known as the “reciprocity” principle and is consistent with international norms in the taxation of international transportation

+9 71 4 393 1773

info@thevatconsultant.com

https://thevatconsultant.com